How Can We Serve You?

Need to Pay Your Property Taxes?

Click the link below to be redirected to the Sheriff’s website.

As tax notices are being sent out, we wanted to answer a couple of questions that arise during this time.

1.) Can I pay my taxes at the Assessor’s Office?

No. The Assessor does not send out tax notices or collect the taxes. The Sheriff is the tax collector for the parish. You can click the tab above to be directed to the Sheriff’s website for payment, send your payment in by mail or pay in person at the Courthouse located at 20300 Government Blvd., Livingston, La. 70754

2.) I believe my values are incorrect, what can I do?

To dispute your assessed value, we need some documentation to verify that the value we have is incorrect. That can be an appraisal that has been done within the last year or the documents page from your Homeowners insurance policy. Please bring these documents with you if you want to discuss your assessment.

Office Hours:

Monday -Thursday 7:30am-5:30pm

Contact Us: 225-686-7278

Mailing Address:

P.O. Box 307

Livingston, La. 70754

Meet Your Assessor: Jeff Taylor

Jeff is a lifelong resident of Livingston parish and has served as Assessor since August 31, 2000. During his tenure, he has served residents with honesty and integrity, working to fairly assess property values across the parish and run a customer-focused office. His efforts have been lauded by local media and industry professionals, most recently being recognized as the Assessor of the Year from the Louisiana Assessor’s Association.

-

File Homestead Exemption Online

Do you need to file a homestead exemption? Save a trip to our office and click the button below to file online.

-

Need to pay your property taxes?

Do you need to pay your property tax? Click the button below to learn more.

-

Assessment Forms

Looking for tax and assessment forms to download and fill out? Click the button below for a full list.

How are my property taxes calculated?

Adjusted millage rates are assigned to all taxing bodies

by the assessor, and by law must be adopted by their

board. However, each taxing body board can then vote

to “roll up” these adjusted millage rates.

THIS IS A TAX INCREASE.

The purpose of reassessment is to ensure the uniform and

equitable valuation of all property, not to raise taxes or

increase revenue for taxing bodies.

The goal is to be revenue-neutral.

That’s why the assessor gives the taxing bodies the

adjusted millage rates.

Each board must hold a public hearing before voting to

adopt the millage rate for their district. This is your

opportunity to address these taxing bodies and speak out

for or against the tax increase.

It is possible for taxes to have increased slightly with any

increased adjusted millage rates, but if a taxing body

rolls up their millage rates it will result in higher taxes.

Did You Know?

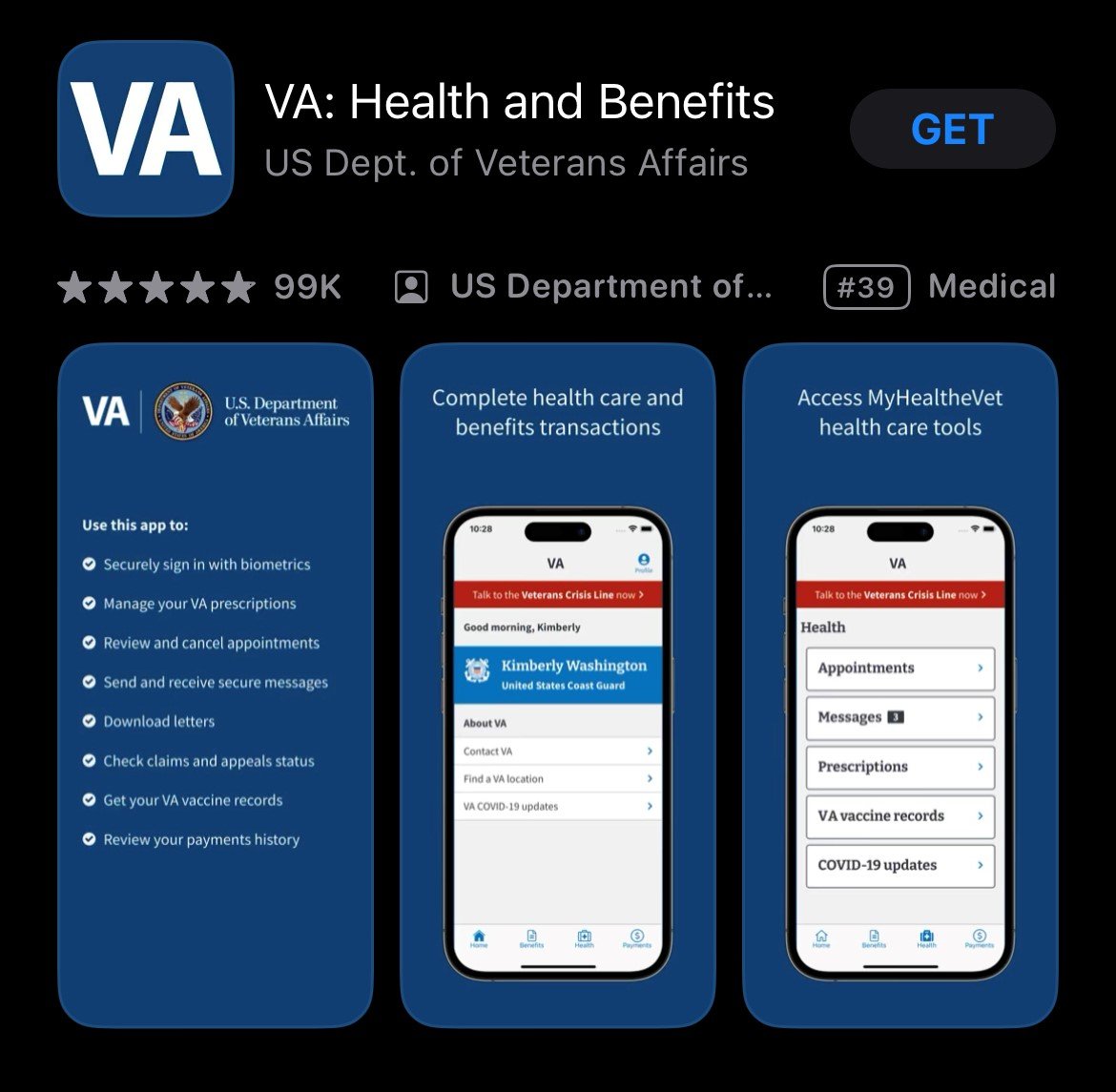

If you are a veteran that has a service related disability and you do not have a copy of your A25 form, you can download the VA app on any smartphone to access your percentage of benefit. If you have still not filed for the new veteran’s exemption, please come by our office with your form or the app to complete the process. Visit our Exemptions section to learn more about it.

We are here to help!